Introduction

In the fast-paced world of modern business, managing invoices efficiently is crucial to maintaining smooth financial operations. Invoice automation offers a powerful solution for businesses looking to streamline their accounts payable processes, reduce errors, and save valuable time. By automating the traditionally manual process of handling invoices, companies can achieve better financial control, compliance, and cost efficiency. This guide will help you navigate the key considerations, essential features, and best practices to choose the right invoice automation solution for your organization.

1. What is Invoice Automation?

Invoice Automation Buyer’s Guide highlights that invoice automation is the use of technology to digitize and streamline the process of receiving, processing, and approving invoices. Instead of manually entering invoice data, matching it to purchase orders, and routing it for approvals, automation software handles these tasks electronically. Platforms like Serina AI specialize in streamlining these functions, offering businesses a seamless invoicing experience.

Key functions of invoice automation include:

- Data Extraction: Capturing relevant data from invoices using technologies like Optical Character Recognition (OCR).

- Validation: Verifying the accuracy of invoice details.

- Matching: Automatically cross-referencing invoices with purchase orders and delivery receipts.

- Approval Routing: Sending invoices to the appropriate personnel for approval.

Businesses of all sizes can benefit from invoice automation, but it is particularly valuable for those dealing with high volumes of invoices or aiming to optimize their financial workflows.

2. Key Benefits of Invoice Automation

- Automated Invoice Processing: Automated systems handle invoice receipt, validation, and routing, drastically reducing manual intervention and enhancing efficiency.

Faster Processing Times: Automation reduces the time required to handle invoices, speeding up payment cycles. Invoices that once took days or weeks to process can now be completed within hours.

- Reduced Human Errors: Automated data capture and validation minimize the risk of costly mistakes such as duplicate payments or incorrect amounts.

- Improved Cash Flow Management: By ensuring timely payment processing, businesses can take advantage of early payment discounts and avoid late fees.

- Enhanced Compliance and Reporting: Automation provides comprehensive audit trails and detailed reports to support regulatory compliance and financial transparency.

- Cost Savings: Reduced reliance on manual labor and paper-based processes leads to significant cost reductions.

3. Factors to Consider When Choosing an Invoice Automation Solution

Factors to Consider When Choosing an Invoice Automation Solution

Choosing the right Invoice Automation Buyer’s Guide solution requires careful evaluation of several factors: Serina AI is a leading provider that meets many of these criteria, making it a strong contender for businesses looking to automate their invoicing processes.

- Scalability: Ensure the solution can handle your current and future invoice volumes. Look for platforms that can grow with your business as transaction volumes increase.

- Integration: Check whether the solution is compatible with your existing enterprise resource planning (ERP) and accounting systems. Seamless integration reduces implementation challenges and data silos.

- Security: Prioritize solutions that offer robust data protection features, including encryption, user access controls, and secure data storage.

- Customization: Opt for a platform that allows tailored workflows, templates, and user permissions to align with your business processes.

- User Experience: Evaluate the user interface for simplicity and ease of use. A solution that is intuitive will encourage user adoption and minimize training requirements.

- Vendor Support: Ensure the vendor provides reliable training resources, ongoing support, and timely updates to keep the system running smoothly.

4. Essential Features to Look For

A robust invoice automation solution should offer the following features:

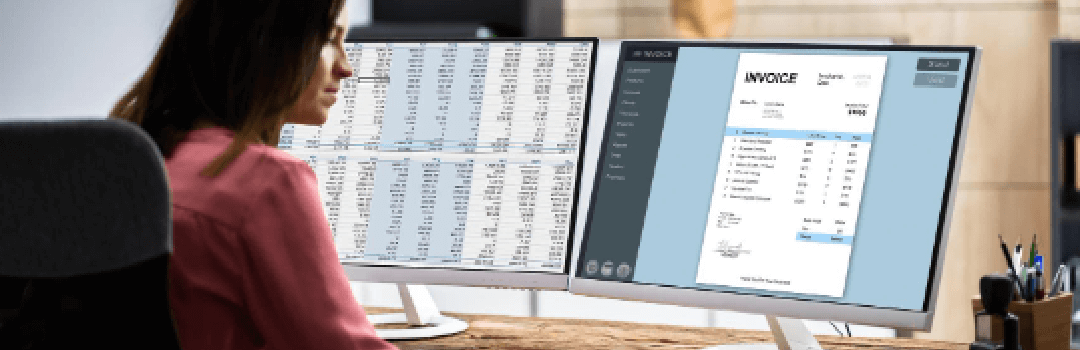

- Automated Data Capture: Technologies like OCR extract data from invoices without manual entry, reducing errors and speeding up processing.

- Invoice Matching and Validation: Automatic matching of invoices with purchase orders, contracts, and receipts to ensure accuracy.

- Approval Workflows: Configurable workflows that route invoices to the right stakeholders for approval based on predefined rules.

- Real-Time Reporting and Analytics: Dashboards and reports that provide insights into invoice status, payment trends, and operational efficiency.

- Automated Invoice Processing: Ensures comprehensive tracking of all financial activities, reducing errors and increasing transparency for compliance audits.

Audit Trails: Comprehensive tracking of all invoice-related activities to support compliance and internal audits.

5. Cost Considerations

When evaluating invoice automation solutions, consider the following cost factors:

- Subscription Fees vs. One-Time Costs: Determine whether a subscription-based model or a one-time license fee aligns better with your budget and operational preferences.

- Implementation Expenses: Factor in the cost of setup, system integration, and data migration.

- Training Costs: Include expenses for user training to ensure smooth adoption.

- Maintenance and Support: Consider ongoing costs for software updates, technical support, and system maintenance.

- Long-Term ROI: Assess the potential savings from reduced processing time, fewer errors, and improved cash flow management.

6. Best Practices for Successful Implementation

To maximize the benefits of your invoice automation solution, follow these best practices:

- Stakeholder Involvement: Engage key stakeholders from the finance, IT, and procurement departments to ensure alignment with organizational goals.

- Clear Training Programs: Provide comprehensive training for all users, including finance teams and approvers, to ensure they understand the system’s capabilities.

- Change Management: Communicate the benefits of automation to employees to encourage adoption and address concerns.

- Automated Invoice Processing: Regular monitoring of automated processes helps identify inefficiencies and ensure that automated invoice processing continues to deliver value.

Continuous Performance Evaluation: Monitor the system’s effectiveness through key performance indicators (KPIs) such as processing times and error rates. Make adjustments as needed to optimize workflows.

- Regular Updates: Keep the software updated to leverage new features and security enhancements.

7. Top Invoice Automation Vendors to Explore

Here are some leading invoice automation solutions to consider:

- SAP Concur: A comprehensive solution offering robust features for large enterprises, including expense and invoice management.

- Tipalti: Ideal for managing global accounts payable with support for multi-currency transactions and tax compliance.

- AvidXchange: Best suited for mid-sized businesses looking for a scalable and user-friendly platform.

- Bill.com: A user-friendly solution tailored for small and medium enterprises, offering integration with popular accounting software.

8. Final Checklist for Buyers

Before finalizing your decision, review this checklist to ensure you’ve covered all essential considerations:

- Is the solution scalable for your business needs?

- Does it integrate seamlessly with your current ERP and accounting systems?

- Are the security features robust and compliant with industry standards?

- Is it customizable to accommodate your workflows?

- How user-friendly is the platform for your team?

- Does the vendor provide adequate training and ongoing support?

- What is the total cost of ownership, including implementation and maintenance?

9. Conclusion

Adopting an invoice automation solution is a strategic move toward enhancing your business’s efficiency, accuracy, and financial control. By understanding your needs, evaluating solutions based on the factors discussed, and following best practices for implementation, you can make an informed decision that drives long-term success. Take the next step to explore available solutions and transform your invoicing process today.